Abax—the lending protocol native to Aleph Zero

Apr 21, 2023

Meet Abax, the first lending platform built with ink! 4.0. With plans for DAO governance and being one of the first DeFi use cases in the Aleph Zero ecosystem, it’s an interesting dApp to keep an eye for its development.

Abax is a lending protocol built on Aleph Zero that aims to expand on the idea and innovate in few areas that enhance the solution’s security and aims to offer fair interest rates.

Let’s dive in to what Abax aims to deliver to the market while being part of the Ecosystem Funding Program.

How Abax works

The Abax protocol is built on Rust and ink!, utilizing Aleph Zero infrastructure. It introduces innovative concepts around liquidity pools and provides a peer-to-contract relationship for lending and borrowing PSP22 tokens with ease and efficiency. The system allows lenders to deposit PSP22 tokens into the liquidity pool, and users who provide adequate collateral can borrow the deposited tokens.

Those who borrow are subject to interest rates that are later distributed to lenders upon repayment. The interest rate for borrowers and lenders is calculated using an algorithm to ensure fairness.

For example, the borrowers’ interest rate is determined by the relationship between the number of funds that have been borrowed and the supply provided by the liquidity pool. The more the liquidity pool is used, the higher the interest rate. This means that interest rates are constantly in flux to match market conditions.

The Abax lending protocol is said to ensure the safety of users’ positions by allowing anyone to monitor for price fluctuations that could result in position liquidation.

Abax Protocol also calculates the maximum debt for each user based on the collaterals and debt that contribute to the user’s position. Each accumulated asset will affect this position differently, depending on a given asset’s volatility. The less risky a position is according to the set criteria, the higher the permitted debt-to-collateral ratio.

The beating heart of the Abax Protocol is the Lending Pool smart contract which manages all the deposits, debts, and interest rate calculations for all registered assets in the pool. The smart contracts governing Abax will be audited, and the code itself is open-source, allowing anyone to inspect the inner working of the project.

Abax protocol’s governance model

As Abax is a DeFi project, it has opted to go the route of other decentralized initiatives and create a decentralized autonomous organization (DAO) to participate collectively in the protocol’s management. An important element of this plan is the introduction of the native token $ABAX, an inflationary token designed to reward those who participate in governance. Through owning $ABAX, users will be able to perform the following actions:

- Staking

- Proposing ideas to the DAO

- Voting on ideas

- Finalizing and executing on the proposals

- Claiming rewards

It takes 21 days to unstake $ABAX, and currently, users can only unstake all of one’s stake. During the unstaking period, it is not possible to stake more tokens.

The Abax Roadmap

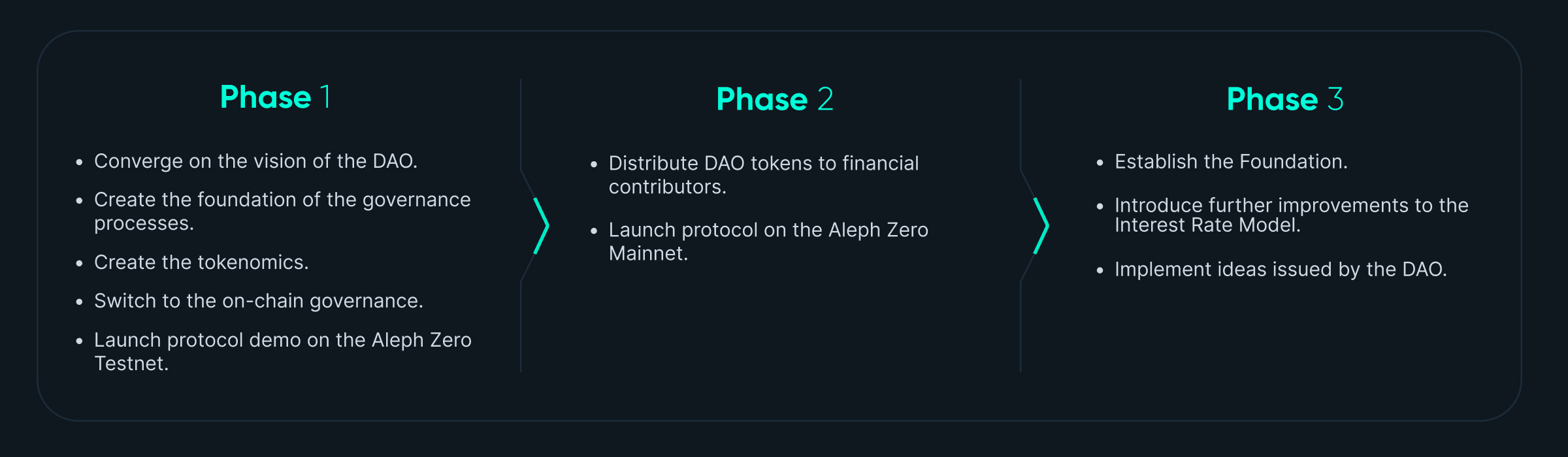

The team at Abax aims to bring the product to the market in three phases that come in a set order.

Part of the Ecosystem Funding Program

The Aleph Zero team is excited to have Abax contribute to the ecosystem, as DeFi applications are a key part of any blockchain ecosystem. The team’s aim to build a fair and secure solution resonates well with Aleph Zero’s community, which is why we’re looking forward to seeing it grow.

As part of the Ecosystem Funding Program, Abax is receiving holistic support in deploying the product, ranging from marketing to code audits.

Have a project that could benefit from the EFP? Learn more and apply!